Business Insurance in and around West Jordan

West Jordan! Look no further for small business insurance.

Helping insure small businesses since 1935

Insure The Business You've Built.

When you're a business owner, there's so much to keep track of. It's understandable. State Farm agent Vincent Campo is a business owner, too. Let Vincent Campo help you make sure that your business is properly covered. You won't regret it!

West Jordan! Look no further for small business insurance.

Helping insure small businesses since 1935

Protect Your Future With State Farm

If you're looking for a business policy that can help cover business property, equipment breakdown, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

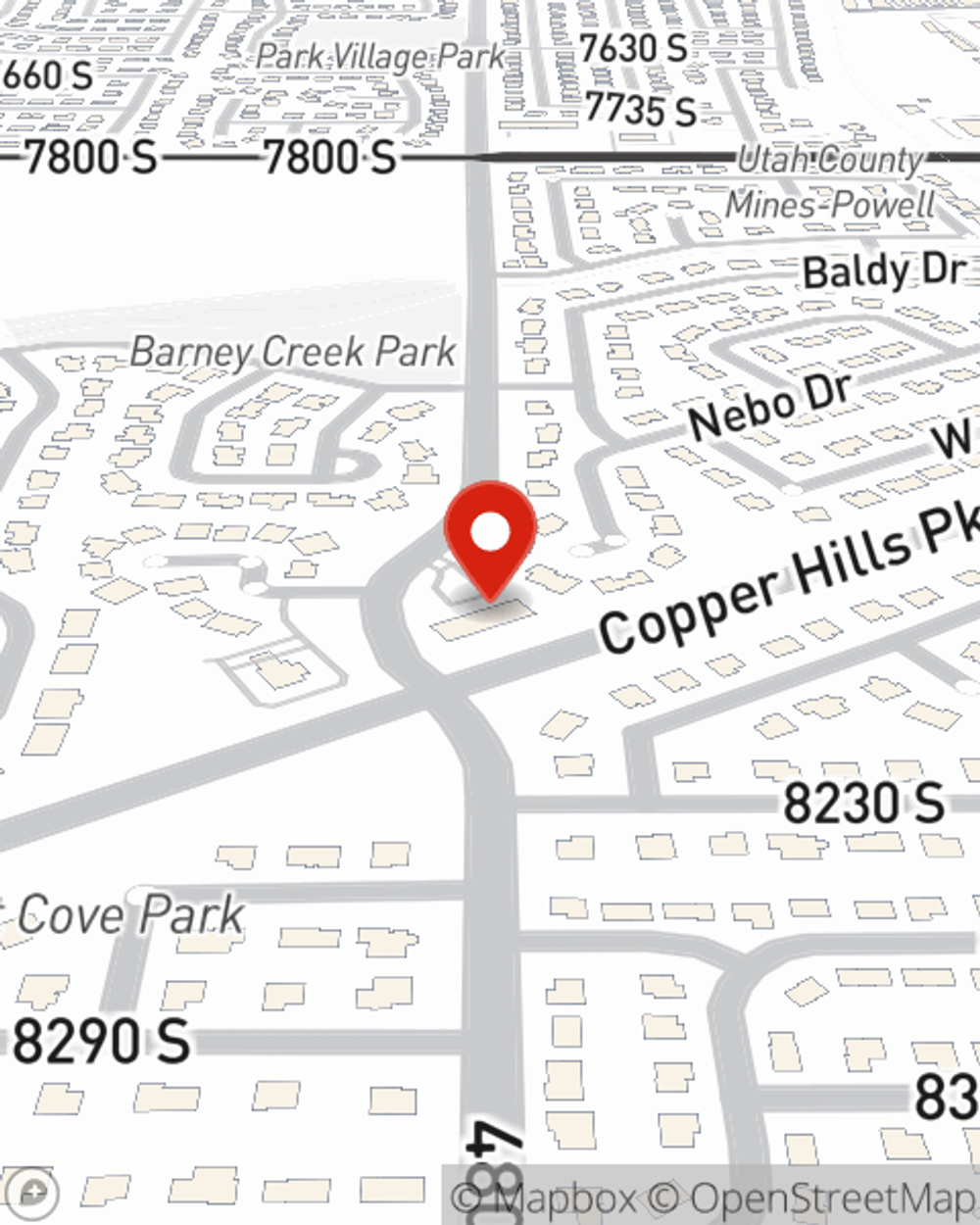

Visit State Farm agent Vincent Campo today to check out how one of the leaders in small business insurance can ease your business worries here in West Jordan, UT.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Vincent Campo

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.